Built on enterprise infrastructure

The status quo

Complex deals. Fragmented tools.

High-scrutiny lending demands rigor, but most teams are stuck with scattered documents, inconsistent processes, and audit trails held together by hope.

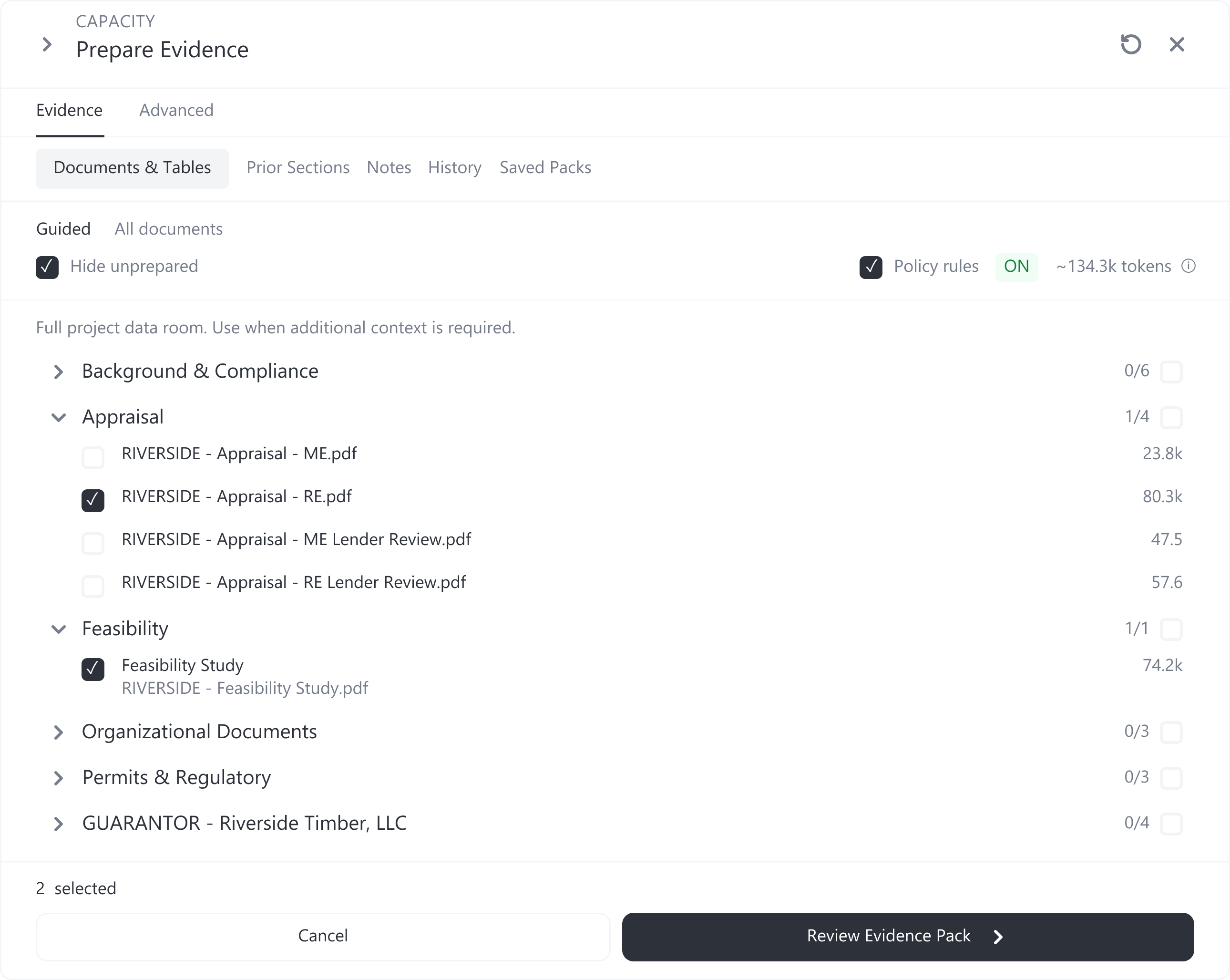

- Scattered documentation

Financial packages arrive across dozens of emails. Critical information lives in someone's head. Handoffs break down.

→ Structured deal workspaces with guided document collection and clear status tracking.

- Inconsistent analysis

Every analyst has their own approach. Memos vary in depth, tone, and rigor. Quality depends on who's assigned.

→ Standardized workflows that flow directly into institutional-quality output.

- Audit exposure

When examiners ask how you reached a conclusion, you're digging through folders hoping the trail exists.

→ Complete evidence linking—every claim traced to source, every edit logged.

The platform

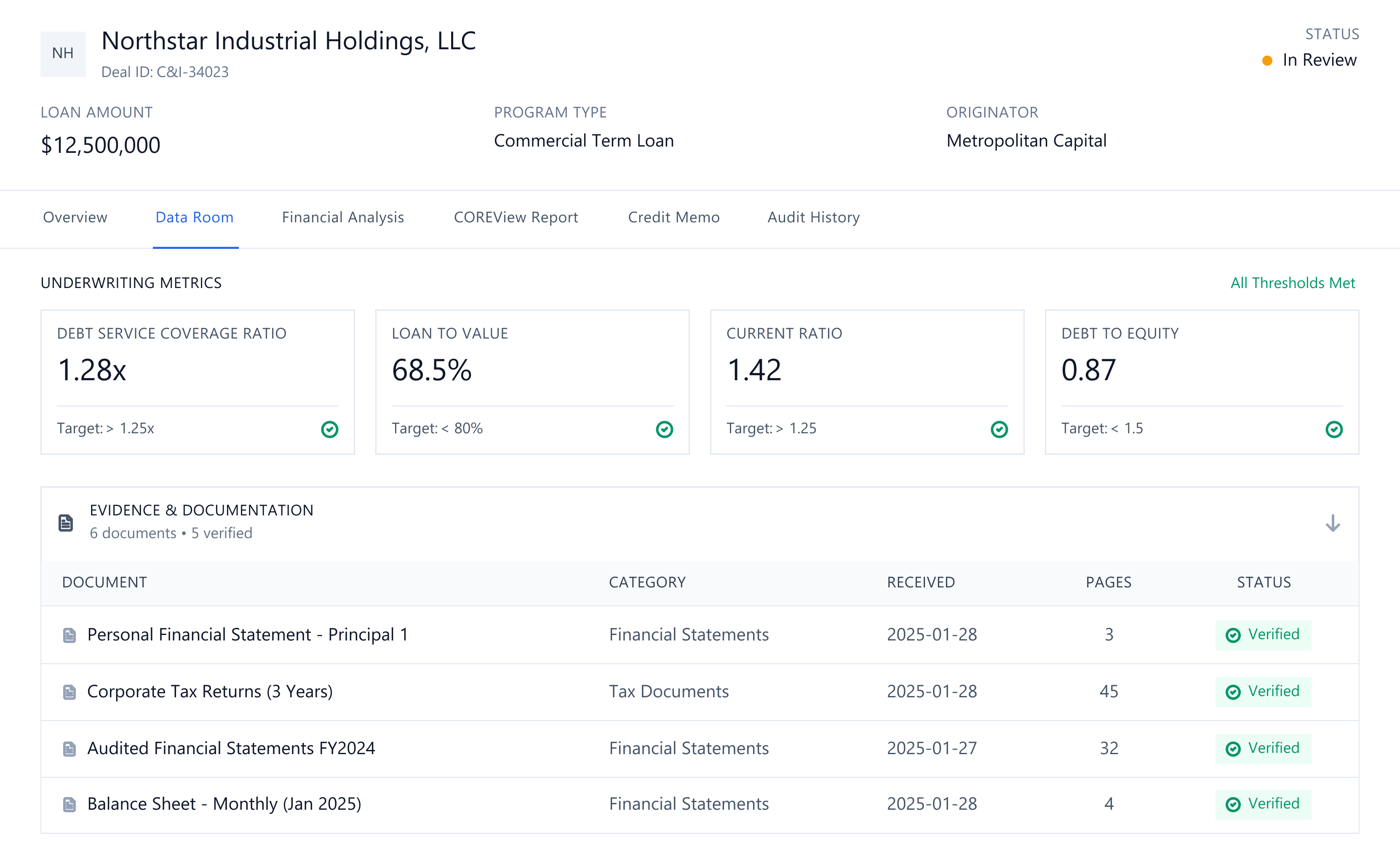

Infrastructure that matches deal complexity

From intake to committee-ready memo—structured workflows that give your team the infrastructure to do their best work consistently.

The workflow

From intake to committee-ready

CORE doesn't replace analyst judgment—it gives your team the infrastructure to do their best work consistently.

- Deal Setup

- 01

- Define the scope. Assign ownership. Structure the file.

- Collection

- 02

- Staged requests. Organized intake. Clear status.

- Analysis

- 03

- Work where analysts already work. Evidence captured.

- Output

- 04

- Memos that reflect your standards. Full traceability.

Built for

Lending environments where documentation matters

- Program lenders

- USDA, SBA, HUD programs with specific documentation requirements and regulatory expectations.

- Infrastructure & project finance

- Long-dated, multi-party transactions with extensive diligence and committee review.

- Credit funds & specialty lenders

- Bespoke structures that require institutional-quality documentation for investors.

- Lender service providers

- Teams supporting institutional clients with underwriting, diligence, and credit administration.

See how CORE handles your complexity

30-minute conversation. See the platform with your use case in mind. No generic demos—we'll focus on what matters to your team.

FAQ

Frequently asked questions

Contact us

Tell us about your lending environment and we'll show you relevant workflows.